Turn Commerce Into

Credit Infrastructure

At Lipafy, we build the revenue layer that powers credit through real-time transaction data captured where commerce happens — and turn it into lending-grade signals.

The Problem

Africa's businesses move trillions in value — but most of it is invisible to lenders.

This is not a lack of money.

It’s a lack of trusted data.

Fragmented Sales

Sales happen offline or in fragmented systems.

Invisible Payments

Payments don’t translate into credit access.

Guesswork Risk

Risk is guessed, not measured.

Underfinanced

Small businesses stay underfinanced.

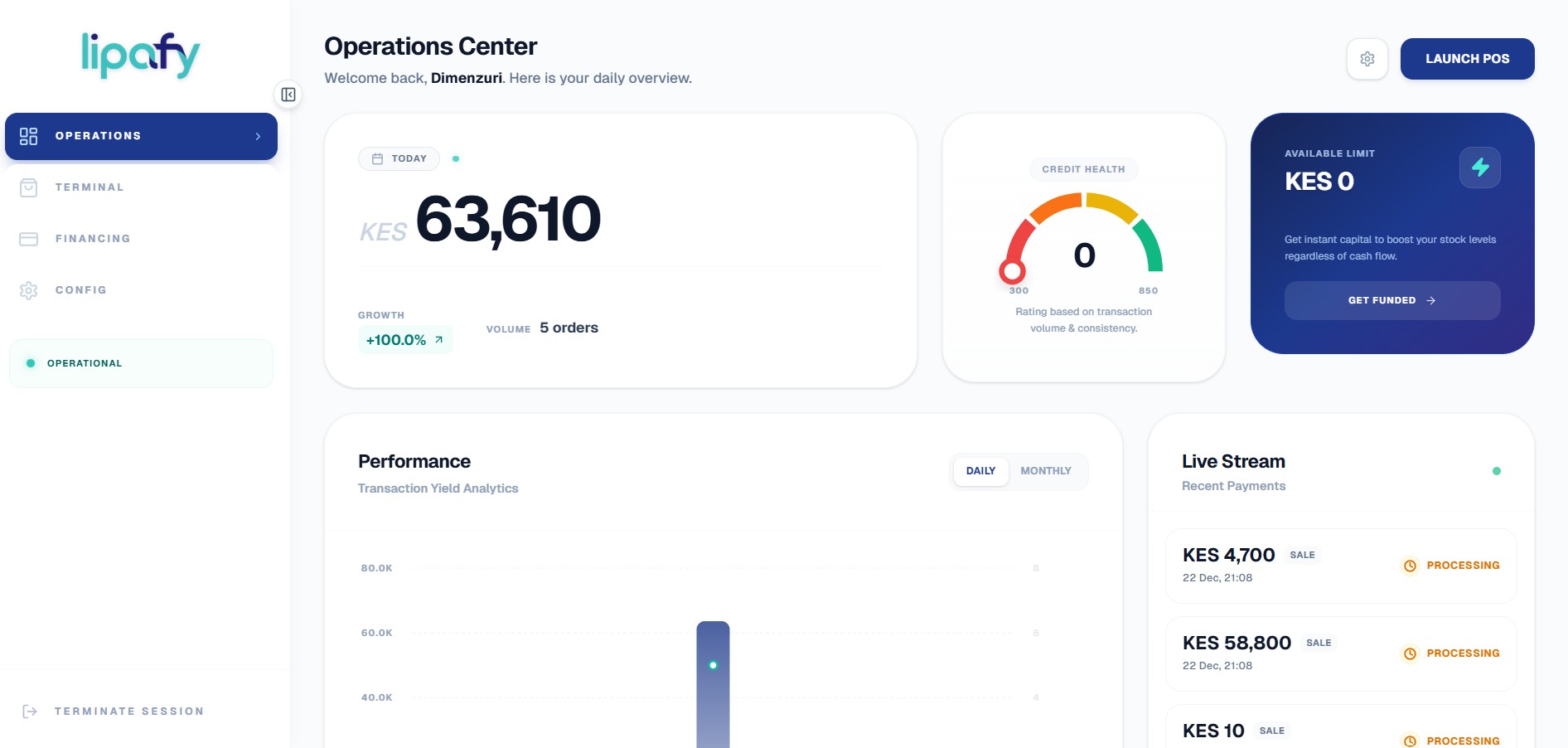

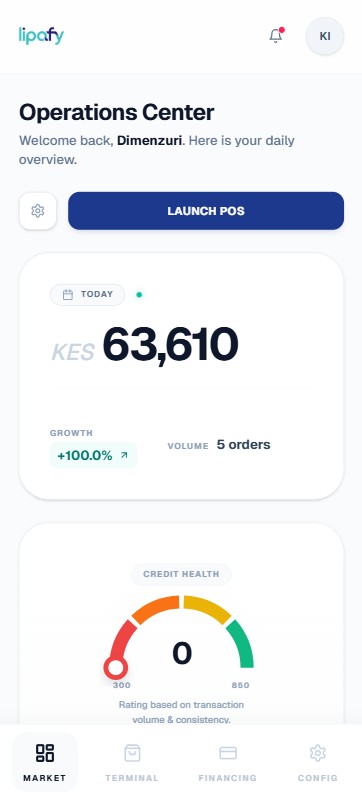

Our Solution

Lipafy creates a continuous, verifiable revenue record.

We sit at the point of sale — in stores, on the street, and online — and transform daily commerce into structured financial data.

- A credit profile

- A risk signal

- A lending decision

How It Works

From Transaction to Credit

1

Capture

Records transactions as businesses operate.

2

Verify

Digital payments confirm authenticity.

3

Score

Models analyze consistency and growth.

4

Unlock

Lenders issue offers based on performance.

Questions all

resolved in one place

Get Started FreeThe Scale Opportunity

10M+

Small Businesses

Daily

High Frequency

Massive

Unmet Demand